Germany’s electricity system continued its transformation in 2025, driven by rapid growth in renewable power generation and meaningful shifts in how electricity is produced, consumed, and integrated into the grid. Data published by the Bundesnetzagentur and Fraunhofer ISE reveal a clear structural trend: renewables are the dominant force in power generation, with solar energy playing an increasingly prominent role within that mix.

Renewables Hold the Majority Share in the Power Mix

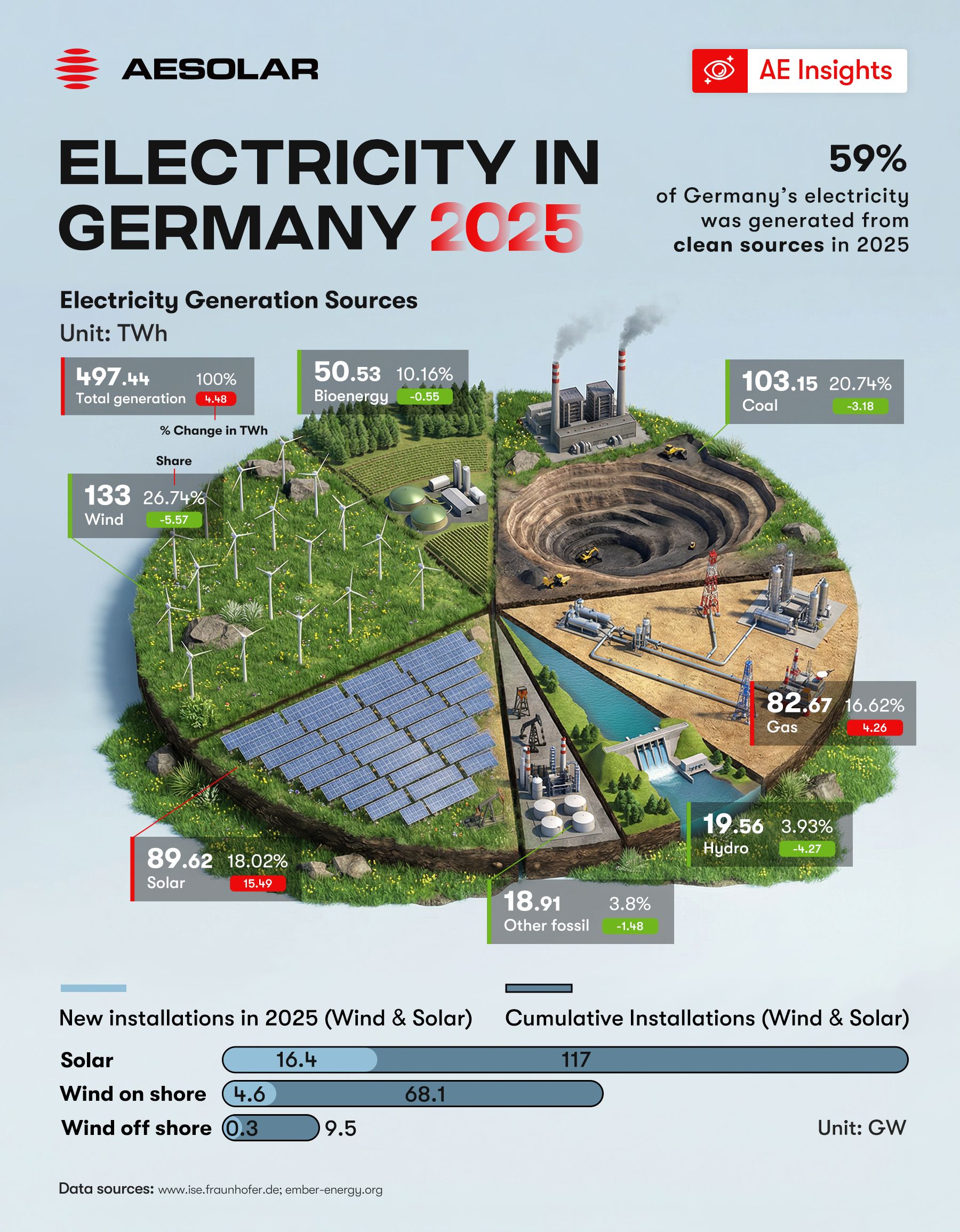

According to official market data, total electricity generation in Germany in 2025 amounted to 437.6 terawatt hours (TWh), nearly the same level as in 2024. Of that, 257.5 TWh — or about 58.8% — came from renewable sources, marking a small but steady increase from the previous year (58.5%).

Wind power remains the largest single renewable contributor, but solar photovoltaic (PV) has emerged as a key growth driver. In 2025, PV systems fed 74.1 TWh into the grid, a significant increase compared with 63.2 TWh in 2024. This growth was driven by both increased installed capacity and favourable solar conditions throughout the summer.

The figures from ember paint a similar picture: solar generation increased by about 16% year-over-year, reaching approximately 89 TWh and overtaking lignite (brown coal) for the first time in terms of electricity production.

Capacity Expansion and Self-Consumption

The solar sector’s expansion is underpinned by steady capacity additions. By the end of 2025, installed PV capacity reached roughly 116.8 GW DC, with around 16.2 GW DC added over the course of the year. Of the total solar production, an estimated 16.9 TWh was consumed directly by the owners of PV systems, highlighting the growing role of self-consumption as a pathway toward local energy resilience and efficiency.

This trend reflects broader behavioural shifts in Germany’s energy landscape, where households, businesses, and communities increasingly value self-generated solar power as a hedge against rising wholesale prices and as a tool to manage peak demand. Distributed solar — from rooftop arrays to small commercial installations — is becoming a foundational element of the energy transition.

Storage and System FlexibilityAlongside generation growth, battery storage is scaling rapidly. Germany’s battery deployment — including home storage and larger commercial systems — grew significantly during 2025. Installed capacity has risen sharply in recent years, with market data registers showing that nearly 25 GWh of storage capacity is now operational, the majority tied to behind-the-meter residential systems.

The expansion of storage enhances grid flexibility and makes high shares of intermittent renewables more manageable, supporting both solar output integration and local energy security. Future scenarios modelled by energy researchers suggest even greater storage needs beyond 2030, indicating a long runway for continued investment and innovation.

Implications for Solar Growth and Distributed Markets

Germany’s electricity data from 2025 illustrates several important implications for the broader solar industry:

Solar climbing the ranks — PV generation’s double-digit growth has elevated solar to a position well ahead of hard coal and lignite in the generation mix, showcasing a structural shift rather than a short-term fluctuation.

Distributed solar as a system asset — the increase in self-consumption reflects the value of localized generation, where residential, commercial, and community solar systems reduce demand on the wholesale grid and help balance peak loads.

Storage synergy — as battery capacity expands, solar pairing with storage enhances network stability and economic optimisation, particularly during midday solar peaks and periods of low wind generation.

Market dynamics and policy alignment — while renewable share growth continues, Germany and the EU still aim for even higher targets through 2030 and beyond, including substantial deployment of both wind and solar. These ambitions align with the broader narrative of the COP30 climate framework, where accelerating clean energy deployment and grid integration are critical.

Opportunities in Niche Solar Markets

The broader trend of solar growth in Germany also underscores the potential of niche PV applications. As the market expands beyond traditional rooftop and ground-mounted projects, opportunities are emerging in segments such as:

- Solar carports, which provide dual land use and grid-interactive capacity near demand centres.

- Vertical and BIPV (Building-Integrated PV) solutions, integrating solar into façades and urban infrastructure.

- Agrivoltaic systems, pairing crop production with energy generation for resilient rural electrification.

- Smart community solar, enabling shared ownership and local energy autonomy.

Each of these niche markets contributes to distributed generation, supports grid resilience, and aligns with Germany’s energy transition goals. The 2025 data reinforces that solar — from utility to niche — is not just a generation technology, but a cornerstone of distributed, flexible, and low-carbon energy systems.

About AESOLAR

AESOLAR is a leading global photovoltaic module manufacturer headquartered in Germany since 2003. With a commitment to German-engineered quality and reliability, the company operates a worldwide distribution network over 100 countries and maintains production facilities across multiple continents. AESOLAR's product range, from high-efficiency mainstream modules to specialized Carport PV, Agri-PV, and BIPV solutions, is designed to drive the global transition to sustainable energy.